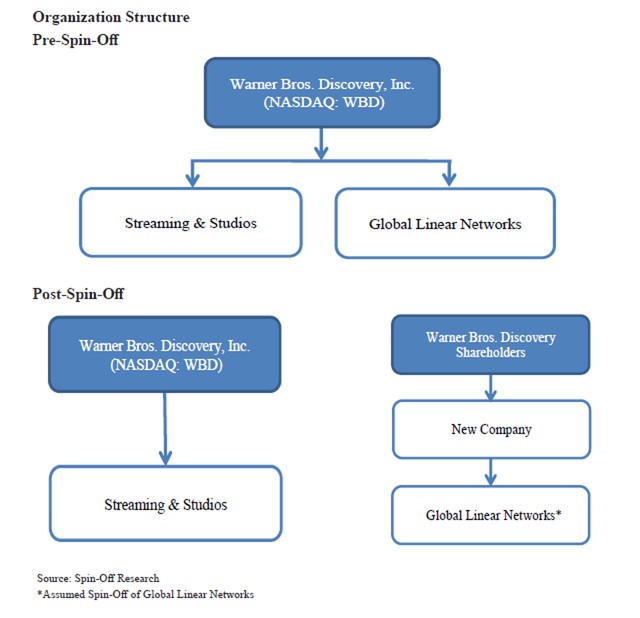

Warner Bros. Discovery (WBD) announced plans for a strategic reorganization that would divide the media giant into two separate operating divisions, marking one of the most substantial restructuring efforts in the entertainment industry.

The company revealed on December 12, 2024, that its board has authorized a new corporate structure aimed at maximizing shareholder value through the creation of two distinct business units: Streaming & Studios and Global Linear Networks.

The Streaming & Studios division will retain control of the company's digital platforms and content creation arms, including HBO, HBO Max, discovery+, Warner Bros. Motion Picture Group, and Warner Bros. Games. This unit will focus on expanding its streaming services and leveraging its extensive entertainment portfolio to drive growth.

Meanwhile, the Global Linear Networks division will oversee traditional television operations, housing popular channels like CNN, TNT, TBS, HGTV, Food Network, and Animal Planet. This segment will prioritize profitability and debt reduction through its established cable and broadcast businesses.

The restructuring process is set to begin immediately, with completion targeted for mid-2025. WBD has enlisted financial heavyweights J.P. Morgan, Evercore, and Guggenheim Securities as advisors for the transition, while Kirkland & Ellis and Wachtell Lipton will provide legal guidance.

This strategic separation reflects the evolving media landscape, where streaming platforms and traditional television networks face different market dynamics and growth opportunities. By creating two focused entities, Warner Bros. Discovery aims to allow each division to better adapt to their respective market challenges and opportunities.

The move represents a major shift in the company's operational strategy, potentially setting a precedent for other media conglomerates grappling with similar challenges in the rapidly changing entertainment industry. In his first major stock sale since leading the Warner Bros. Discovery merger, CEO David Zaslav has sold approximately $30 million worth of company shares, according to a recent SEC filing.